is property tax included in mortgage ontario

Each property owner in the municipality pays a proportion of that 2000 based on their propertys assessed value. In order for TD to pay your property taxes we collect a portion of your annual estimated property taxes with each regular mortgage payment.

Mortgage Interest Deduction What You Need To Know Mortgage Professional

When you pay off your mortgage in full you also take over responsibility for ensuring your property tax gets paid in full and on time.

. First if you have a down payment of less than 20 you wont have enough equity in your home for your lender to consider allowing you. For example the City of Toronto has a City Building Fund Levy that is used for public transit and housing projects in Toronto. Property tax is included in most mortgage payments.

Want to see what homeowners across ontario pay in property taxes on homes assessed at 250000. Contact your mortgage lender to set up tax payments to be included with your mortgage. The cost of the propertys mortgage may also be included in the monthly fee.

DHI Mortgage Property Taxes and Escrows. The homeowner can create a savings account and receive interest payments towards paying the property tax. Is property tax included in mortgage Ontario.

The amount is 6500 per thousand dollars. Hey all been a while since Ive posted but keep reading and. Property taxes are included as part of your monthly mortgage payment.

However as Ontario home prices saw unprecedented growth over the last year the benchmark home. With some exceptions the most likely scenario is that your. Updated September 18 2022.

The MCAP Property Tax Service is complimentary for all our mortgage holders. Ontario administering the property tax is certainly one of the most importantnot least because the property tax is the single biggest source of revenue for municipalities. This would amount to 58 per year.

Only the interest portion of the. Your property tax payments are based on the assessed value of your home and the property tax rate where you live. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

Some cities may add additional taxes. This is calculated by first tallying the value of all three. Assessed Value x Property Tax Rate Property Tax.

For example the current tax rate in Toronto is 0611013. So if you make your monthly mortgage payments on time then youre probably already paying your property taxes. 2020 Education Tax Rate.

The monthly rent for a 1000 borrowed will be 80. If your county tax rate is 1 your property tax bill will come out to. If you qualify for a 50000.

There are two primary reasons for this. Hence 4 will be required to be spent. Lets say your home has an assessed value of 200000.

If your property is not located within a municipality contact the Provincial Land Tax Office in Thunder Bay for questions about your Provincial Land Tax account s payment s tax. So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently changed to 185bi-weekly payment because its not enough to cover the. When solely paying as part of the mortgage there is no.

If you received a refund or rebate in 2021 of real estate taxes you paid in 2021 reduce your deduction. Ontario sales tax on CMHC insurance When applicable the cost of CMHC insurance is added to your mortgage balance and paid off over the amortization of your.

:max_bytes(150000):strip_icc()/CreatingaTax-DeductibleCanadianMortgage2_3-32287bf83e94406aba3b1d625e6c295f.png)

Creating A Tax Deductible Canadian Mortgage

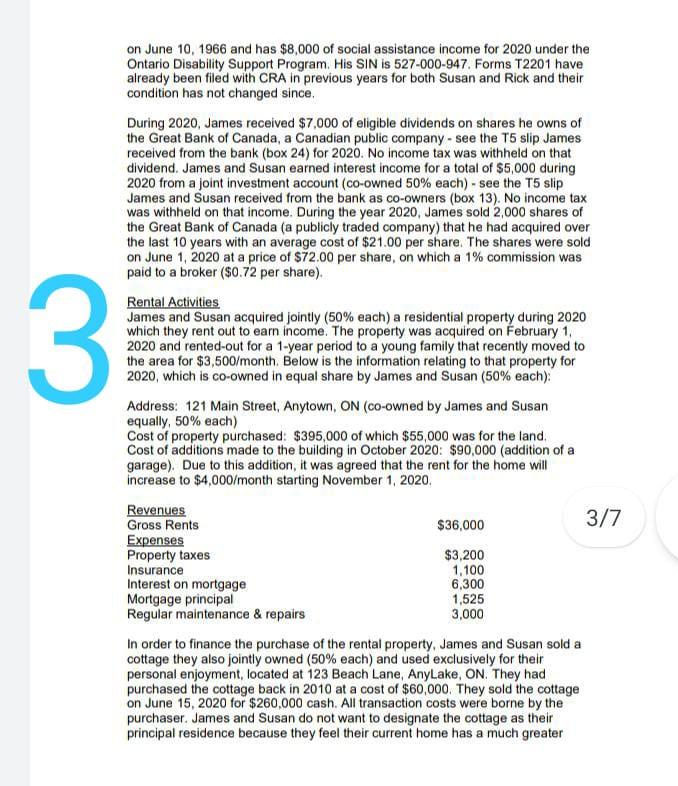

1 Comprehensive Case Study 2021 You Are Required To Chegg Com

What You Need To Know About Condo Property Tax

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Can You Write Off The Difference Between The Rent Collected Mortgage Paid

How To Invest In Real Estate The Motley Fool

Is Property Tax Included In Your Mortgage Rocket Mortgage

Mortgage The Components Of A Mortgage Payment Wells Fargo

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

The Importance Of Debt To Income Ratio For Investment Property

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Frequently Asked Questions About Ontario Property Tax Rates Zoocasa

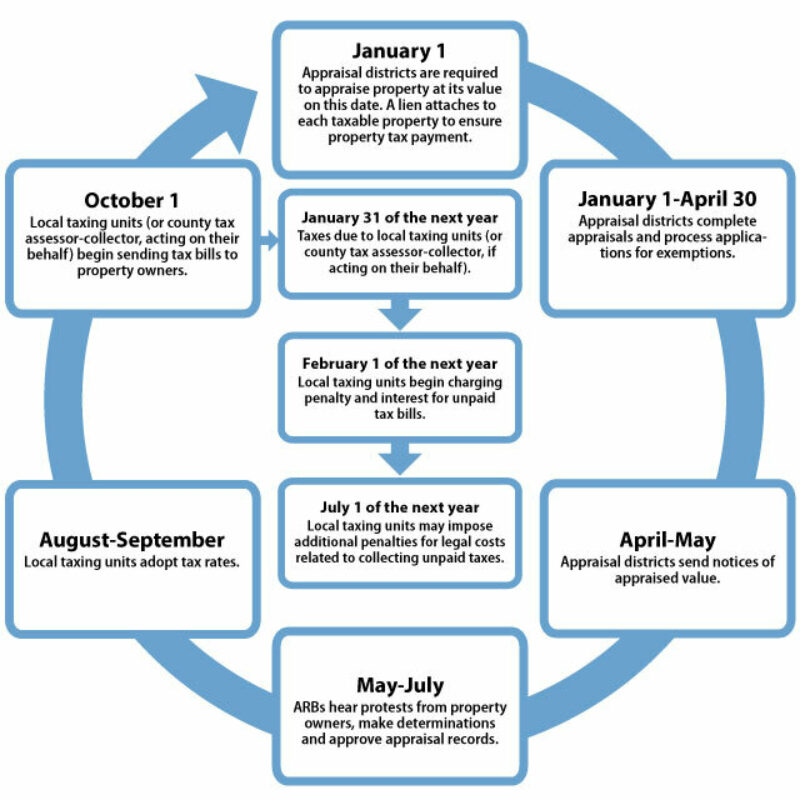

All About Property Taxes When Why And How Texans Pay

![]()

Property Taxes Included With Monthly Mortgage Payment R Personalfinancecanada

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Is Property Tax Included In Your Mortgage Rocket Mortgage

What Am I Paying For With My Monthly Mortgage Payment

New York Property Tax Calculator 2020 Empire Center For Public Policy